The Oregon Senate on Monday in a party-line 18-11 vote passed a long-awaited transportation bill that will update the state’s funding sources for road maintenance and operations.

House Bill 3991 will raise about $4.3 billion over the next 10 years to fund road maintenance and operations by raising the gas tax by six cents, nearly doubling most vehicle registration fees and doubling the payroll tax used to support public transit from 0.1% to 0.2% of a paycheck — among other fee hikes for electric vehicles. Gov. Tina Kotek plans to sign it.

The bill settles a growing gap in Oregon’s transportation budget and prevents transportation department layoffs, but advocates warn it’s just a temporary fix and overlooks key issues such as climate sustainability, traffic congestion and road safety near schools — all while Republicans pledge to bring the matter before voters in 2026.

Sen. Khanh Phạm, D-Portland and a co-chair of the joint committee that produced the bill, said that Oregonians are better off when they can safely travel to cities for concerts, deliver goods for small businesses and count on county roads being well-maintained and free of potholes.

“Oregonians demand and deserve nothing less than a government that wants to invest in connecting them to each other,” she said.

What’s in the transportation package?

The bill would raise taxes and fees, including:

- A gas tax increase from $0.40 to $0.46, effective Jan. 1, 2026.

- An increase in annual registration fees from $43 to $85 for passenger vehicles; $63 to $105 for utility vehicles, light trailers, low-speed vehicles and medium-speed electric vehicles; and $44 to $86 for mopeds and motorcycles.

- Increasing title fees for passenger vehicles from $77 to $216

- Doubling the payroll tax used to support public transit from 0.1% to 0.2% until Jan. 1, 2028

- An increase to registration surcharges for electric and highly fuel-efficient vehicles, from $35 to $65 annually for cars with a 40+ mpg rating and from $115 to $145 annually for electric vehicles.

- Phasing in a mandatory road usage charge program for electric vehicles by 2031. Electric vehicle drivers have been able to opt into the OReGO program and pay 2 cents per mile in exchange for lower registration fees, and the proposed change would mandate electric vehicle drivers participate in that program or pay a flat $340 annual fee.

Within the first 25 minutes of floor debate, Senate Republican Leader Bruce Starr, R-Dundee, attempted to block the bill from moving forward by offering two amendments, one of which would have freed up existing funds within the Oregon Department of Transportation budget and allowed the agency to direct it to immediate needs. Starr’s other amendment would have given Oregon voters the final say on whether to approve or reject the bill in the November 2026 general election. Both motions failed.

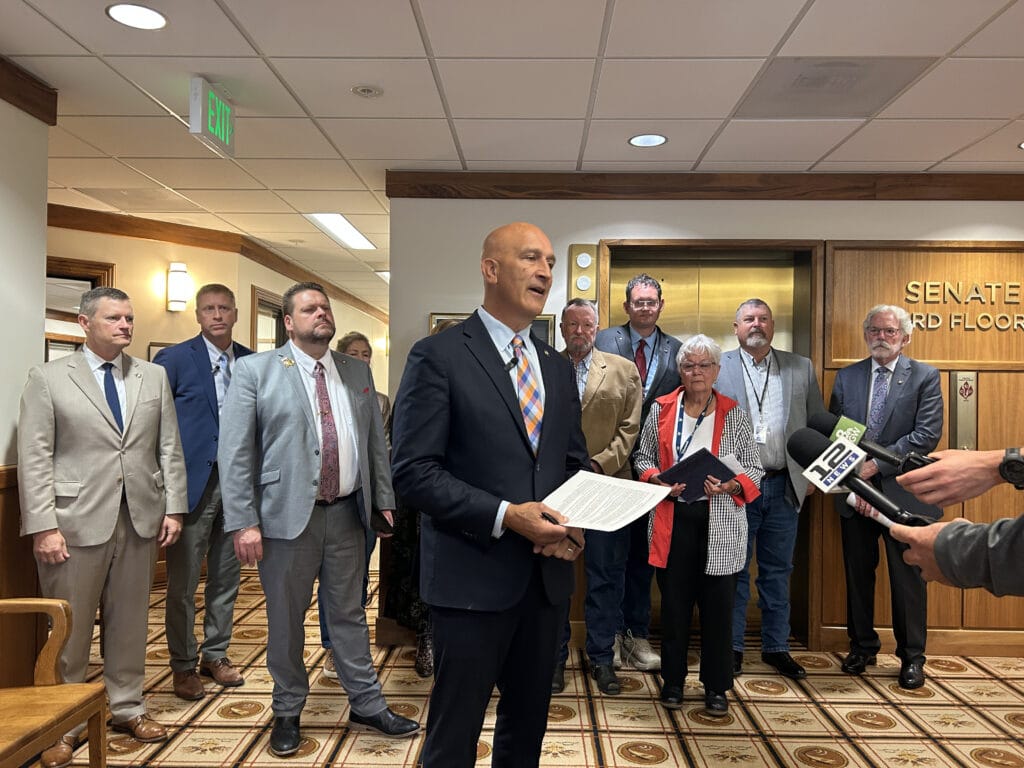

During a press conference after those motions failed, Starr said Republicans don’t want roads to deteriorate or for transportation employees to lose their jobs. He criticized Kotek and Democrats for not collaborating on a bipartisan transportation solution and said Republicans will work to create a referendum, or allow Oregon voters to reject or approve the legislation in the November 2026 election.

Sen. David Brock Smith, R-Port Orford, said many of his constituents can’t afford the tax and fee hikes in the transportation bill.

“It’s going to hurt my rural Oregonians more because they have lower income levels and have to drive farther for goods and services than anywhere else, and they’re not driving a fuel-efficient vehicle to do so,” he said at the conference.

Oregon Democrats expressed support for the bill, with some calling it a good start and others saying it’s insufficient.

“It does not reduce greenhouse gas emissions, it does not address seismic vulnerabilities, and it does not reflect the testimonies calling for clean air and reliable transit,” said Sen. Courtney Neron Misslin, D-Wilsonville. “So yes, I am disappointed… but I’m certainly voting yes because this bill is necessary to keep essential services of transit.”

Kotek in an afternoon press conference surrounded by supporters of the bill said she suspended 483 pending transportation department layoffs that would have taken effect Oct. 15 as soon as the bill passed the Senate, adding that the department is already behind on hiring for the winter season.

“We’re going to move forward with the assumption we have this,” she said, responding to Republican plans to challenge the measure through a referendum. “What I would say to folks is think twice about referring this. Let’s all come together as a state and make sure we have the right tools.”

While some Republicans said their voices weren’t heard in this bill, Kotek said the state needed a viable solution to filling the transportation department’s funding shortfall.

“There are a lot of people standing behind me who represent folks across the state who are registered Democrats, Republicans and independents,” Kotek said. “Unfortunately, I don’t think we saw something that was viable from Republicans. And as a result, they were not able to support (the bill).”

Kotek said she doesn’t know when the bill will reach her desk so she can sign it into law.

How did we get here?

The last time Oregon passed a major transportation bill was in 2017. Today, the Oregon Department of Transportation is facing significant budget shortfalls driven by declining tax revenue, inflation and spending restrictions. Without new ways of adding revenue, the department would have to lay off almost 500 workers and scale back essential services like road maintenance, snow removal, customer support and highway and graffiti cleanup.

Lawmakers failed to compromise on a transportation bill during the regular six-month legislative session, so Kotek called for a special session over Labor Day weekend to address the budget shortfall.

The Oregon House passed the bill on Sept. 1, but a Senate vote was postponed twice because Sen. Chris Gorsek, D-Gresham, was recovering from surgery and Democrats needed his vote for the bill to pass.

Kotek twice delayed the Oregon Department of Transportation from laying off its workers in anticipation of passing a bill in the special session. With the bill’s passage, no state transportation workers will lose their jobs.

A short-term fix: Groups respond to bill’s passage

The Association of Oregon Counties applauded the bill’s passage. The bill preserves how the state splits the revenue raised from the gas, with half going to the state, 30% to counties and 20% to cities.

The legislation makes it possible for counties to maintain current road department services and operations, but it’s just a short-term fix, the association said.

“Over the last three decades, counties have been forced to make difficult decisions like downsizing road crews, reducing services and postponing crucial safety interventions and routine maintenance,” Association of Oregon Counties Road Program Director Brian Worley said in a statement. “Without stable long-term revenue, counties will continue to be forced into service and staffing reductions and will see deteriorating and more dangerous roads.”

The Street Trust, an Oregon-based transportation advocacy nonprofit, said the bill creates future instability because it ends transit funding in 2028 and keeps road safety investments at 2017 levels.

“We’re glad ODOT workers’ jobs were saved, and we’ll always fight for living-wage public sector employment,” The Street Trust Executive Director Sarah Iannarone said. “But let’s be clear: if Oregon continues on this trajectory, we will see rising deaths on our roads, worsening inequality and communities left behind in ways that will be hard to come back from.”

Move Oregon Forward, a coalition of climate, equity and transportation advocates, criticized the bill’s mandatory road usage charge, saying it unfairly penalizes drivers who drive electric vehicles and makes driving an electric vehicle one of the most expensive ways to drive.

“In the 2026 short session, we need to fix issues like the Road Usage Charge and EV taxes, along with new accountability and revenue tools,” said Kristopher Fortin Grijalva, the transportation program director at Oregon Environmental Council. “By 2027, we aim to deliver a truly fair, safety-forward, climate-smart transportation package that serves everyone in Oregon,”

The future of public transit also remains uncertain, Move Forward Oregon said. Although House Bill 3991 doubles the payroll transit tax, that tax increase will expire in 2028.

“I use transit to keep my life moving and reduce my transportation costs,” Cassie Wilson, the legislative manager of 1000 Friends of Oregon, said in a statement. “For me and so many others, service cuts mean longer waits, fewer options and more economic uncertainty. We need the legislature to build a transportation system for the future, not just short term fixes.”

- 5:13 pm: Updated with a response from Gov. Tina Kotek

- 3:24 pm: Updated with reactions and more information about the bill.

This story originally appeared in the Oregon Capital Chronicle and is republished here under a CC BY-NC-ND 4.0 license. Read more stories at oregoncapitalchronicle.com.